Check out these easy-to-follow, four simple tips to fix your credit score and creating good credit. Did you know that 8 out of 10 credit reports have errors or mistakes on them? Sadly, many of us have late payments and derogatory information being reported as well.

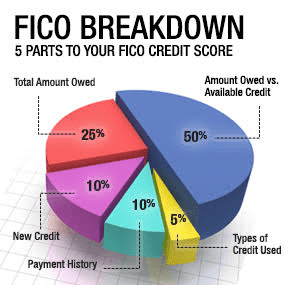

As a consumer, you’ve learned the importance of establishing a good credit rating with your lenders. Whether you are shopping for a new home or auto or searching for the best deals on insurance, your creditworthiness will be judged by your credit rating or credit score.

Bad credit history or bad credit habits will place “black marks” on your credit profile. These include things such as late payments, having an account assigned to a collection agency, and of course, bankruptcy. At this point, you would need help to fix your credit.

Establishing good credit habits and, therefore, a good credit rating will improve your creditworthiness. This will be reflected in potential lenders offering you substantially lower interest rates and better deals on credit offers.

Here are four simple tips to help you create a shining credit profile:

1) Pay Your Bills on Time

Lenders only have your past payment history to decide the type of credit risk you present to them. How you pay off your debts now indicates to them how you will pay off future debts.

2) Don’t Use Too Many or Too Few Credit Cards

So, how much is too much? How little is too little? Many credit experts and financial planners suggest two to four credit cards are just the right mix.

3) Pay at Least the Minimum Due

Always pay at least the minimum due payment, but never less. And remember, just paying the minimum amount means it will take you years and years to pay off that credit card.

Example: Paying off a $2,000 credit payment at 18% APR with a minimum monthly payment of 2% ($40 or less) will take you 30 years to pay off the amount plus interest.

4) Review Your Credit Report Regularly – Use these tips to fix your credit score

Monitor your credit report from all three major credit bureaus – Experian, TransUnion, and Equifax – regularly. Also, be sure to check your credit profile at least annually. And review it carefully and make sure that any past mistakes or disputes have been corrected.

Credit Tip Regarding Your Identity

Also, if you notice an account listed that you know that you have not personally opened, contact that creditor and the credit bureaus immediately.

This could be a sign that you’ve had your identity stolen. Request to have a fraud alert placed on your profile and account to protect yourself and your credit. Identity theft is the fastest-growing consumer crime in America, with an estimated 1 million people victimized each year.

In closing, if you follow these tips to fix your credit score, you will be ahead of many people who don’t take the time. Additionally, establish good credit habits early in life. This way, you can reap the benefits that your good credit rating will provide you for the rest of your financial future.