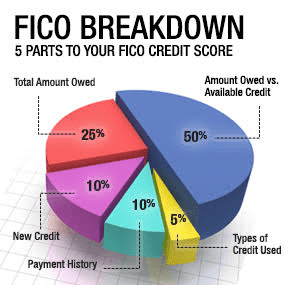

If you’re asking how to fix my credit score or looking for a company that offers legitimate help with credit repair, it’s best first to understand the different types of scoring models.

Have you ever gone to buy a car or get qualified to purchase a home only to be told your score is completely different from what you thought it was? Below we go over the most utilized scoring methods we see every day.

First, a little fact, there are 60+ different FICO scores. Having dozens of different credit scoring models can truly make your head spin. In our credit restoration service, the models we most often see are the Vantage Score, Fico Score 2,4, 5, Fico 8, and The Auto Score.

The most widely used and most often seen by consumers are the Vantage scores – the scores you get from Credit Karma, Free Credit Report, and dozens of other online services. We use Smart Credit mostly in our company, and it is effortless to follow. You can check them out here. To work on fixing your credit score go over your report first.

But, which score should you focus on? It actually depends on what you wish to purchase or apply for.

Before You Fix Your Credit Know The Models

Vantage Score is what we see as the most widely used scoring system. It’s not an inaccurate score. It’s just not what lenders use for mortgage lending or auto purchases. The credit bureaus Experian, Trans Union, and Equifax created the vantage model. By creating this model, they did not have to pay Fico or Fair Isaac for theirs. They did this to sell their own scores to consumers and make more money. This score tends to be a bit lower than other scoring models as well. Lastly, and most importantly, Vantage scores are not the same as a FICO score. Many people get these two confused all the time.

Fico Score 2,4 & 5 These scoring models are for mortgages. A completely different type of lending scoring. All banks and lenders use this for qualifying for a home loan. Clients do not see these unless they go to MyFico.com. And it runs about $60 to pull this score. One thing to know is MyFico does not list account numbers if you need those when pulling a report.

Annual Credit Report gives you a free credit report each year but does not score unless you buy it.

Fico 8 This is a later model than 2,4, and 5. Lenders never adopted this new model, but credit cards companies did.

Auto Score-Fico is completely different from all other scoring models for buying a car. This score is different because they go off all previous auto loans you had in the past. So they do not factor in the same things the others do. And this scoring model could be much higher or lower.

Now that you have a basic understanding of the different scoring models used, you can work on your credit report accordingly to maximize your buying power. As well, be able to secure the lowest interest rate possible. If you’re asking how to fix my credit score fast? We offer a full audit of your file to help create a comprehensive action plan. This will help you in making sure your report and score are as accurate and clean as possible.

If you have time on your hands, perhaps you may wish to order a, Do It Yourself program, which is, frankly, the most comprehensive DIY out there today. Either way, taking the time to handle these matters will be worth it in the long run for you and your family. Don’t let this opportunity slip by you.