Doing extensive research in the marketplace before applying for a new credit card can also help. Consider all fees and perks when applying for new cards or loans – don’t sign up for overpriced ones by mistake. There is an optimal solution to maintaining good credit, and it’s making the wisest decision at the outset. Don’t get a card and max out the balance if the rates are too high.

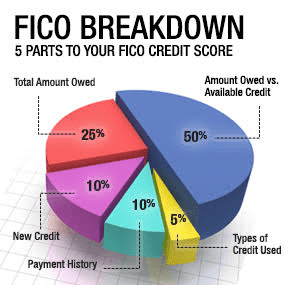

You want to keep your utilization down below 30%. Those looking to get a home mortgage loan may not be aware of all their options. Many people will walk into a bank without knowing what’s available and accept whatever terms & conditions are offered to them, thinking that’s all they can qualify for. Most credit reports have errors and mistakes on them.

Taking Time To Research

I am sure you have seen the pages of newspapers, television, and other advertising sources…families and individuals are filing bankruptcy at record levels because they cannot afford their homes anymore. But, these people did not take the time to check and clean up their credit reports first and ultimately search for the best options available to them. As you can see, now these millions of people are deep in debt and searching for a way to repair their credit.

The solution to avoiding bad credit and repair is to research, invest wisely, make sound financial decisions, and create and stick to a budget. Being informed and educated is two of the best tools we can use. There are also other loans available that offer low mortgage monthly installments and low-interest rates with insurance policies attached that will pay your mortgage if you become sick, unemployed, in an accident, and so on.

On the other hand, mortgage loans have high interest rates, high mortgages, and balloon payments attached to them. But, when balloon payments are attached to home mortgages, it is almost guaranteed in a few years, you will be searching for refinancing. If you lose your home, you will also have to repair your credit.

To tell the truth, if you want to avoid having bad credit and ultimately needing credit repair, you want to stay on the right path. Don’t overborrow, and make sure your credit is at the highest level you can get to secure the best loan for anything you purchase.

Other Credit Tips:

Car Loans: Alternatively, it is also important to research the marketplace carefully before agreeing to any terms & conditions if you are applying for a car loan. Make sure that you find the best deals affordable to you. Many years ago, I learned a trick many dealers use. This rule is that most car dealers increase the fees on cars by 15%. Not to mention, this means if you negotiate with the dealer, you can get a reduction on the vehicle up to 15%.

Credit Cards: Another word of advice is when applying for credit cards, you want to stay away from cards with fees attached and high-interest rates. Avoid credit card offers that have upfront fees offer a high line of credit. Again, you want to keep your utilization down to 30% or less. This helps maximize your credit score. Not paying them off each month.

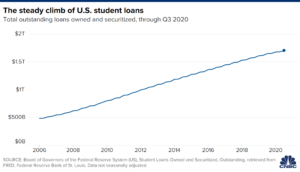

Student Loans: Additionally, before applying for student loans, you should check for grants as you may be qualified for a grant or Pell Grant from the government. This is the first place you want to start before committing yourself to a student loan agreement. In closing, Make sure to clean up your credit before getting any card, mortgage loan, installment loan, etc. This will save you thousands in interest payments. Why pay more if you don’t have to. Using these simple and quick credit tips will help you repair your credit report down the line.