Many credit reports have errors or mistakes, and sometimes late payments occur. In the paragraphs, below are five quick tips to improve your credit profile.

1) Get copies of your credit report and profile — then make sure the information is correct.

First, Go to the Annual Credit Report website. Under federal law, you can get a free report from each of the three national credit reporting companies every 12 months.

You can also call 877-322-8228 or complete the Annual Credit Report Request Form at the Federal Trade Commission (FTC) website and mail it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

2) Pay your bills on time.

Secondly, one of the most important things you can do to improve your credit score is to pay your bills by the due date. You can set up automatic payments from your bank account to help you pay on time. But be sure you have enough money in your account to avoid overdraft fees.

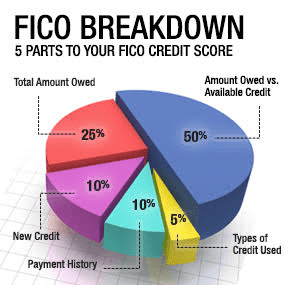

3) Understand how your credit score is determined.

The answers to these questions determine your credit score:

Do you pay your bills on time? The answer to this question is critical. If you have paid bills late, have had an account referred to a collection agency, or have ever declared bankruptcy, this history will show up in your credit info.

What is your outstanding debt? Many scoring models compare the amount of debt you have and your credit limits. If the amount you owe is close to your credit limit, it will likely hurt your score.

How long is your credit history? Short credit history may harm your score, but a brief history is offset by other factors, such as timely payments and low balances.

Have you applied for new credit recently? If you’ve signed up for too many new accounts recently, that may negatively affect your score. However, suppose you request a copy of your own credit report or creditors monitor your account or look at credit reports to make prescreened credit offers. So, In that case, these inquiries about your credit history are not counted as applications for credit.

How many and what types of credit accounts do you have? Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However, too many finance company accounts or credit cards might hurt your score.

To learn more, see the Federal Trade Commission’s publication on credit scoring at their website.

4) Learn the legal steps you must take to improve your credit report.

The Federal Trade Commission’s “Building a Better Credit Report” has information on correcting errors in your report. So, read the tips on dealing with debt and avoiding scams—and more.

5) Beware of credit-repair scams.

Lastly, sometimes doing it yourself is the best way to repair your credit. The Federal Trade Commission’s “Credit Repair: Self-Help May Be Best” explains how you can improve your creditworthiness and lists legitimate resources for low-cost or no-cost help. Additionally, we also offer a do-it-yourself program, so you do have choices.