To understand what actually goes into the basics of a credit score breakdown in the US. You need to be aware of the critical role credit rating plays in their lives.

There are several different scoring methods, but most lenders and banks rely on the FICO method that has been in existence since the 1980s when the Fair Isaac Corporation developed it. The three main credit bureaus (TransUnion, Experian, and Equifax) worked with Fair Isaac to develop the FICO method.

Your credit score may be any number from 300 to 850. Relatively good credit nowadays is considered to be above 690, which the average American falls at about 690. However, while this score should secure you a loan, it will not get you the very best interest rates for these loans.

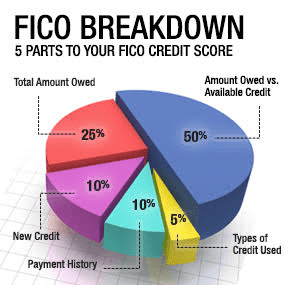

Following is the credit score breakdown:

Payment History:

Payment history is the most significant chunk of your score (35%). This score is influenced by how well (or not) you pay your bills on time, how many have been sent to collection agencies, bankruptcies, tax liens, etc.

Keep in mind that missing a payment is worse than making a late payment. Being late or especially missing a mortgage payment is a more significant blow to your credit score than missing a credit card or utility payment.

Outstanding debt:

The amount of debt you have (compared to the amount of credit you have not used) accounts for 30 percent of your score. Try not to max your credit cards out. Using only 25 to 50% of the credit that is available to you is recommended. Bringing it down to 10% is best.

A way to balance this out is to obtain more lines of credit and not use them. However, you do not want to apply for too many credit cards at one time. If your credit is in good standing, apply for a reputable card every six months or so. This way you can save it for a rainy day.

Credit duration:

Fifteen percent of your credit score is based on how long you’ve established credit. The longer your credit history, the better your overall score will be. More data about your past leads to a more accurate prediction of your future creditworthiness.

Types of credit:

In managing your report, having various kinds of credit will boost your score as long as you keep the utilization ratio low—types of credit count for 10 percent of the overall rating.

Too much activity:

As mentioned earlier, opening new credit accounts all at once will negatively affect your score in the short term. It’s also essential that you know that it can lower your score if you have too many “hard inquiries” about your status. A “hard inquiry” is one that you have authorized a lender to perform. If you are inquiring about your score, this will not count against you.

Understanding what goes into the credit score breakdown is the first step in improving your score. To get more detail on your situation, please feel free to email us or fill out a free consultation request. Then you can speak to a trustworthy credit specialist about your situation.